Mississippi to 720

Mississippi to 720 is an initiative dedicated to improving credit scores for individuals and empowering professionals to help their clients become financially qualified for major purchases.

Where do we currently stand?

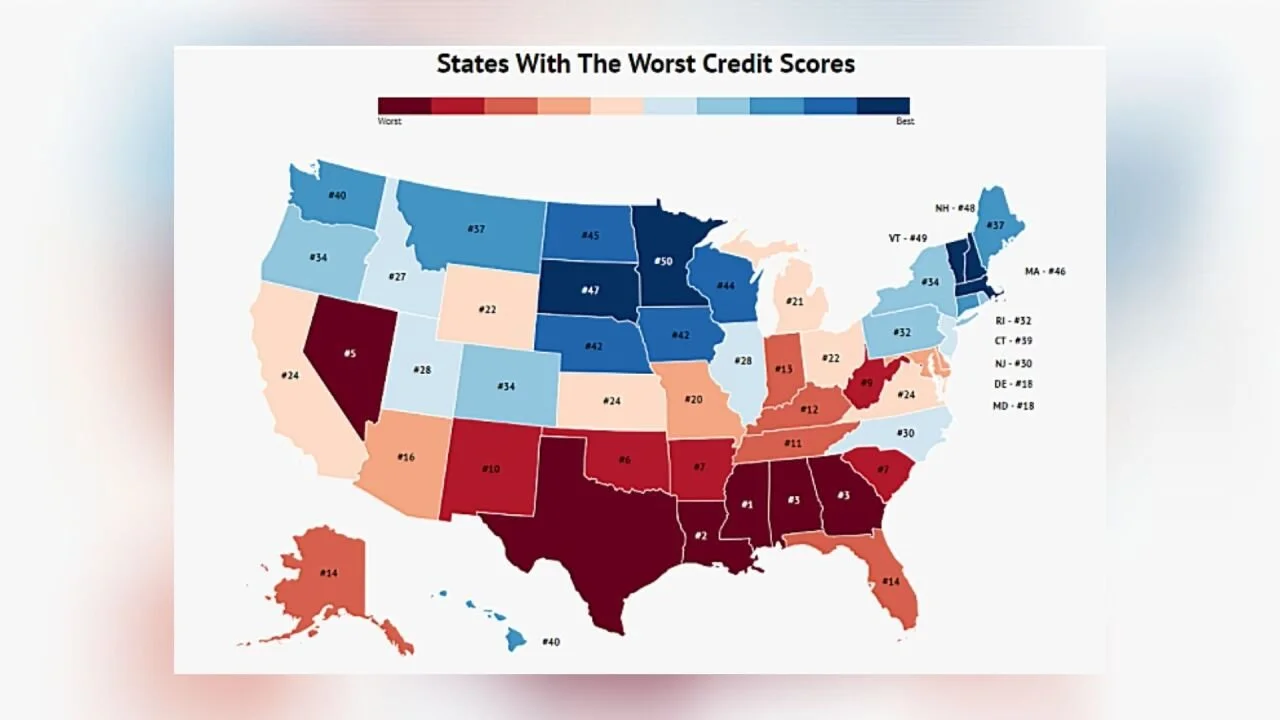

The average FICO credit score in the US is 717, according to the latest FICO data. The average VantageScore is 701 as of January 2024.

Average credit scores also vary significantly based on location. The average Minnesota resident has a 742 FICO credit score, the highest average of any state.

Meanwhile, the state with the lowest average FICO credit score is Mississippi, at 680. Yours or your clients may be even lower.

Let’s Look at Some Credit Score Facts!

Your credit score impacts everything from loan approvals to interest rates on credit cards and much more. Here is a list of a few areas of your life that are affected by your credit score.

Insurance Premiums: Insurance companies often use credit scores to determine premiums for auto, home, and renters insurance. A higher credit score may lead to lower insurance premiums, as it is seen as a marker of financial responsibility.

Employment Opportunities: Some employers may check credit scores as part of the hiring process, especially for positions involving financial responsibilities or access to sensitive information. A good credit score can enhance your job prospects.

Housing Rentals: Landlords and property management companies may check credit scores when evaluating rental applications. A higher credit score can improve your chances of getting approved for a rental property and may even lead to better rental terms.

Utility Deposits: When setting up utilities such as electricity, water, or internet services, utility companies may review your credit score. A lower credit score may require you to pay a higher deposit to establish service.

Cell Phone Plans: Similar to utility companies, cell phone providers may also consider credit scores when determining eligibility for postpaid plans. A better credit score may allow you to access more favorable terms and lower deposits

Credit Card Limits: Your credit score influences the credit limits on your credit cards. Higher scores can result in higher credit limits, providing more financial flexibility.

Negotiating Power: When applying for loans or negotiating terms with lenders, a strong credit score gives you leverage to negotiate better interest rates, fees, and terms.

After reading through all of that, don’t you think you should be actively working to increase your credit score? By understanding the wide-ranging impact of your credit score, you can make informed financial decisions and take proactive steps to improve your financial health.

Why Your Credit Score Matters

A high credit score opens doors to better financial opportunities, including lower interest rates on loans, easier approval for mortgages, and access to premium financial products. In Mississippi, where credit challenges are common, improving your score can significantly enhance your ability to secure a home, car, or business loan. By boosting your credit score, you increase your financial flexibility and save money in the long run, positioning yourself for a more secure and prosperous future. Let us help you take the steps to unlock these opportunities and achieve lasting financial stability.

Increasing Score & Financial Qualification (Individuals)

Our Step-by-Step Process

1. Budget Analysis: Increasing Your Monthly Cash Flow

Detailed evaluation of income and expenditures.

Actionable strategies to cut unnecessary expenses (including emotional spending).

Custom budget plan to ensure more money at the end of the month.

2. Aggressive Savings Plan

Development of a savings strategy tailored to personal goals.

Regular check-ins to ensure savings targets are met.

3. Credit Repair

Dispute inaccurate information and remove errors on credit reports.

Negotiate with creditors to resolve outstanding issues.

4. Building Credit for the Future

Strategies for opening secured credit cards, maintaining healthy credit utilization, and managing accounts responsibly.

5. Changing Financial Behavior for Long-Term Success

Coaching on financial habits that prevent falling back into debt.

Education on smart financial decision-making for the future.

Expected Outcomes

- Increase in credit score and financial stability -

- Increased Savings Account Balance -

- Long-term change in financial behavior to avoid previous pitfalls -

- Become qualified to make large-scale purchases -

Helping Your Clients Get Financially Qualified

We’re primarily looking to work with real estate agents, mortgage lenders, car salespeople, financial services professionals, furniture and large appliances, outdoors salespeople, etc.

You refer your unqualified leads to us and we work with them to improve their financial situation, get them qualified, and send them back to you to make their purchase.

Client Qualification Collab (Professionals)

Services Offered to Professionals

Client Budget Analysis & Counseling

Work with your clients to analyze their spending habits.

Help them create a realistic budget that frees up income for major purchases.

Client Savings Plan Development

Create aggressive savings plans to meet down payment or purchase needs.

Coaching on strategies to build reserves for upcoming financial milestones.

Client Credit Repair Assistance

Take hands-on action in disputing errors on their credit reports cleaning up any discrepancies.

Support the client’s negotiations and advocate on behalf of the client with creditors to resolve negative marks.

Client Credit Building Support

Teach clients how to responsibly build credit history and improve their score.

Changing Financial Behavior for Sustainable Credit Health

Long-term coaching on financial habits to ensure clients remain financially healthy after their purchase.

Benefits to Your Business

- More financially qualified clients -

- Increased success in closing sales and securing loans -

- Receive new client referrals from our network -

- Long-term client relationships based on trust and financial guidance -

More of Mississippi’s State of Financial Affairs

We’re trending in the right direction, but we have much more work to do.

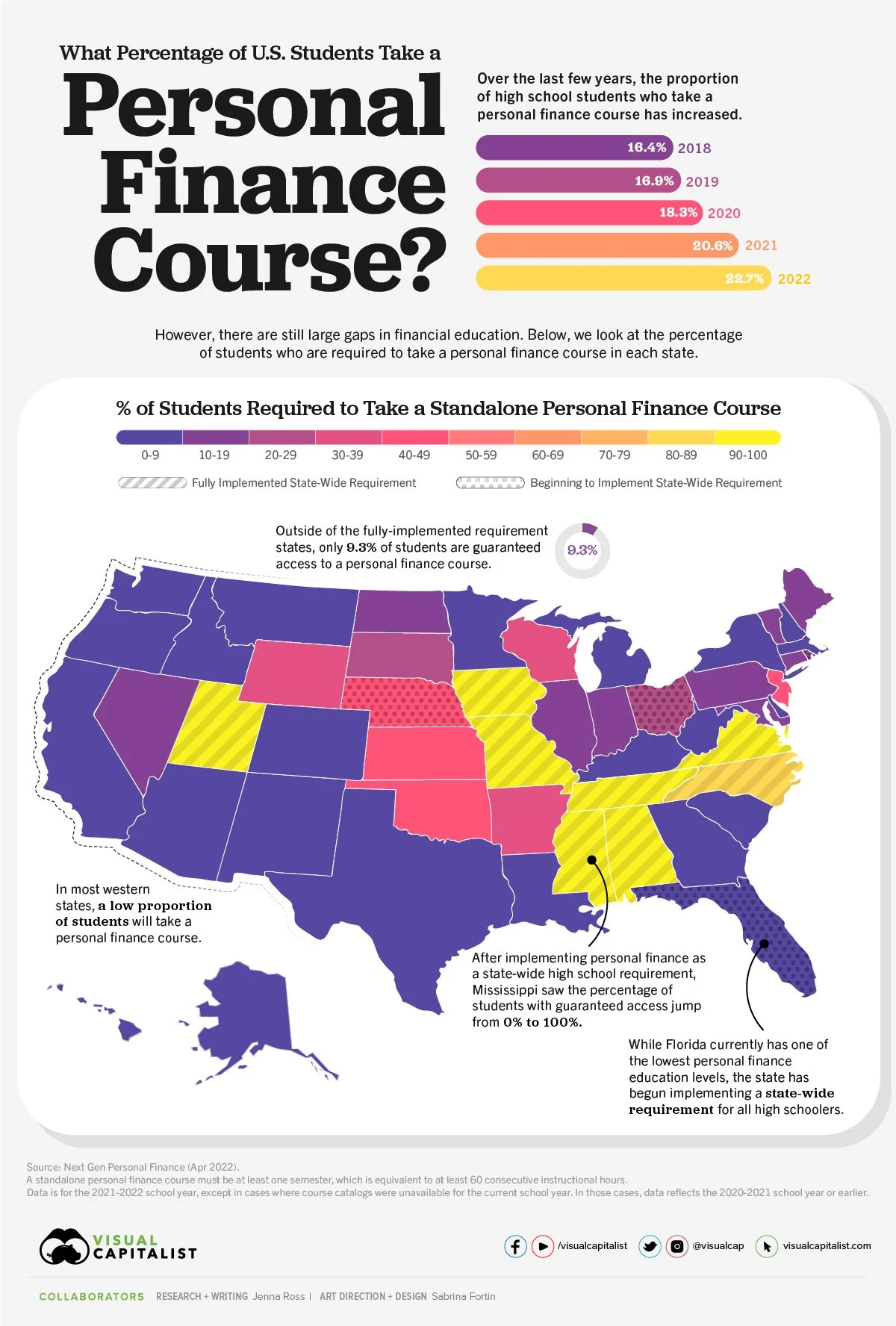

1. Financial Literacy Levels:

- According to a survey by the Financial Industry Regulatory Authority (FINRA) Investor Education Foundation, only 34% of Mississippi adults were able to answer four or five basic financial literacy questions correctly in 2019. This indicates a significant gap in financial knowledge among residents.

2. Education Initiatives:

- Mississippi requires personal finance education to be integrated into high school curriculum. However, as of 2020, only 17 states required a standalone personal finance course for high school graduation, according to the Council for Economic Education's Survey of the States.

- Various organizations such as the Mississippi Council on Economic Education (MCEE) and local nonprofits work to provide financial education workshops and resources to schools and communities across the state, but more work needs to be done.

3. Economic Challenges:

- Mississippi's median household income was $45,792 in 2020, significantly lower than the national median income of $68,703 (U.S. Census Bureau data).

- The poverty rate in Mississippi was 19.6% in 2019, higher than the national average of 10.5% (U.S. Census Bureau data).

4. Access to Financial Services:

- In 2019, approximately 14.7% of households in Mississippi were unbanked, meaning they did not have a checking or savings account, compared to the national average of 5.4% (FDIC National Survey of Unbanked and Underbanked Households). That's where we come in!

- Limited access to affordable financial services in rural areas and certain urban neighborhoods can contribute to financial exclusion and challenges in building credit. That’s where we come in!

5. Workforce Development:

- Workforce development programs in Mississippi aim to not only improve job skills but also incorporate financial literacy training. These programs target individuals across various age groups, including youth entering the workforce and adults seeking career advancement opportunities. We will be helping add onto these opportunities.

These statistics highlight the ongoing need for comprehensive financial education efforts, economic development strategies, and increased access to financial services to improve the financial wellbeing of Mississippi residents. Let’s get on the phone and start the process of becoming part of the solution.

How we Work

Once you complete the attached form below, we will schedule our initial consultation.

From there we will determine your contract, outline our work plan, process your fee, and start working to get you qualified.